About the Investment Banking Group (IBG) at Virginia Tech

IBG is a student‑run organization providing structured training, real‑world simulations, and mentorship to prepare Hokies for careers in investment banking and high‑finance roles.

Group Overview

We run a multi‑phase program that mirrors top banks: technical foundations, modeling bootcamps, deal simulations, and interview prep. Alumni mentor underclassmen, drive accountability, and elevate outcomes each year.

- Hands‑on training around real deal workflows.

- Peer & alumni mentorship from analysts and associates on the Street.

- Data‑driven prep, accountability, and continuous feedback.

Training Process

Foundations & Technicals

Accounting refreshers, 3‑statement linkage, valuation frameworks, Excel best practices.

Modeling Bootcamp

Public comps, deal comps, DCF/rDCF, LBO & merger modeling with speed and accuracy.

Interview & Execution

Behavioral drills, technical reps, case prompts, and live‑fire deal simulations.

Key Concepts Taught

- Working capital, cash flow drivers, forecasting mechanics.

- Integrated models with robust checks and sensitivities.

- Trading comps, precedent transactions, DCF/rDCF, APV, SOTP.

- Sanity checks, bridges, and investor‑grade outputs.

- Debt schedules, returns waterfalls, accretion/dilution.

- Case‑style sprints mirroring recruiting prompts.

- Executive‑ready slides, structure, visual clarity.

- Mock sell‑sides and live feedback sessions.

Example Analyst Path in IBG

- Join IBG & start training

- Attend weekly meetings

- Paired with mentor

- Wrap up summer training

- Master technical concepts

- Build résumé & network

- Interview preparation

- Story refinement

- Secure internship

- Full‑time recruit if needed

- Take executive role in IBG

- Take on mentorship role

- Support recruiting

- Support mock interviews

- Pre‑internship training

- Leadership & mentorship

- Lock in return offer

- Internship presentation

- Provide mentorship

- Leave legacy

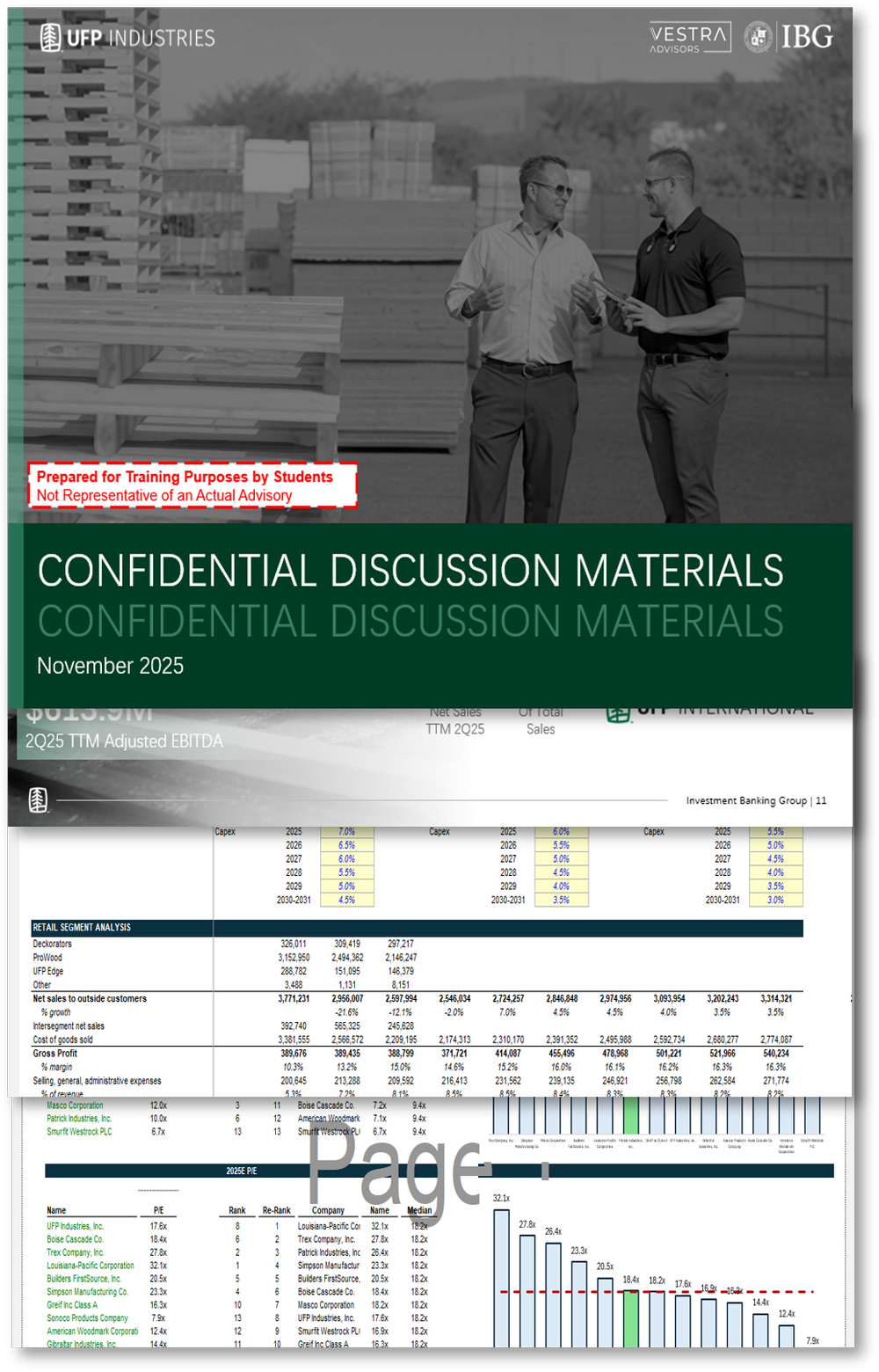

Deal Simulations

Members run compressed, realistic projects culminating in executive‑style presentations with alumni feedback.

- Semester‑long engagement led by IBG analysts.

- Create a teaser and targeted buyer list.

- Build valuation & operating models (comps/DCF; sensitivities).

- Draft a Confidential Information Presentation (CIP) with messaging.

- Present to alumni acting as prospective buyers and iterate from feedback.

Advisory Projects

We partner with real investment banks on live‑fire projects. Teams deliver market studies and strategic‑alternatives presentations that mirror professional advisory work.

- Market landscaping & competitive dynamics

- Valuation bridges and scenario analysis

- Strategic alternatives deck with recommendations

- Executive‑style readout to bankers and alumni

Impact & Outcomes

Ready to level up your finance career?

Join our next recruiting cycle, attend an info session, or reach out to learn how IBG helps Hokies break into the Street.